Search Results for '091-534600'

7 results found.

Budget 2026 – Investing in Ireland’s Future

The Minister for Finance, Paschal Donohoe, and the Minister for Public Expenditure and Reform, Jack Chambers, presented the first Budget of the coalition Government on Tuesday October 7.

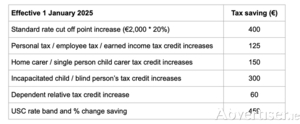

Budget 2025 - A balancing act

The Minister for Finance, Jack Chambers, and the Minister for Public Expenditure and Reform, Paschal Donohoe, presented the fifth Budget of the coalition Government on Tuesday.

Budget 2024

The Minister for Finance, Michael McGrath, and the Minister for Public Expenditure and Reform, Paschal Donohoe, presented the fourth Budget of the coalition Government on Tuesday. This Budget was framed against a backdrop of the ongoing war in the Ukraine, concerns about persistent inflation and the perceived windfall nature of corporation tax receipts.

Budget 2020 — All you need to know

The Minister for Finance Paschal Donohoe presented his fourth Budget on Tuesday. As was well signalled, this Budget was framed against the backdrop of a potential no deal Brexit. Given the current reality of climate change, unsurprisingly climate related initiatives have featured prominently within the measures announced. The details announced also include certain tax increases, limited changes to personal tax, together with targeted measures for SMEs.

Budget 2019 — The highlights

The Minister for Finance Paschal Donohoe presented his third Budget on Tuesday against the backdrop of continuing improved economic performance. Budget 2019 sees the distribution of the benefits of the improving economic conditions, mostly in the form of increased Government spending. Some of the key expenditure areas highlighted by the Minister included social and affordable housing, health and childcare, education, Brexit and climate change. On the tax front, there was a mixture of tax increases and modest tax reductions.

Budget 2018 – a summary

Minister for Finance and Public Expenditure and Reform Paschal Donohoe presented the second Budget of the Minority Government Fine Gael-Independent Coalition. Minister Donohoe announced that the total Budget package of €1.2bn favours expenditure increases over revenue reductions reflecting the Government’s commitment to invest in key areas such as education, health, childcare and housing. The Minister also announced additional capital expenditure of €4.3bn over the next 4 years.

Knowledge Development Box – to encourage more innovation

Since Minister Noonan announced in October 2014 that Ireland would introduce a “best-in-class” Knowledge Development Box (“KDB”), there has been a lot of speculation about ‘how low would he go’. Budget 2016 announced that the rate of tax which will apply for income qualifying under the new KDB will be 6.25%. The relief is available to companies for accounting periods beginning on or after 1 January 2016.